Introduction

Stepping into finance and mortgage broking management can be a game-changer for your career. The diploma of finance and mortgage broking is more than just a course; it is a key that unlocks the door to the bustling mortgage broking industry. This diploma mortgage broking program is crafted to help you understand complex money matters in simple ways, guiding you to become a pro at handling special financial circumstances. It is not just about learning; it is about becoming a part of a community that shapes the future of the financial services industry.

As you dive into this mortgage broking course, you will gather essential skills in high demand. You will learn to use industry standard software that all the top finance and mortgage brokers rely on. Plus, you will explore various units of competency that make you excellent at what you do. By the end of this journey, you will emerge with a diploma level qualification from the National Finance Institute, recognized across Australia. This is not just education; it is your pathway to becoming an accredited mortgage broker, ready to make a mark in the financial services sector.

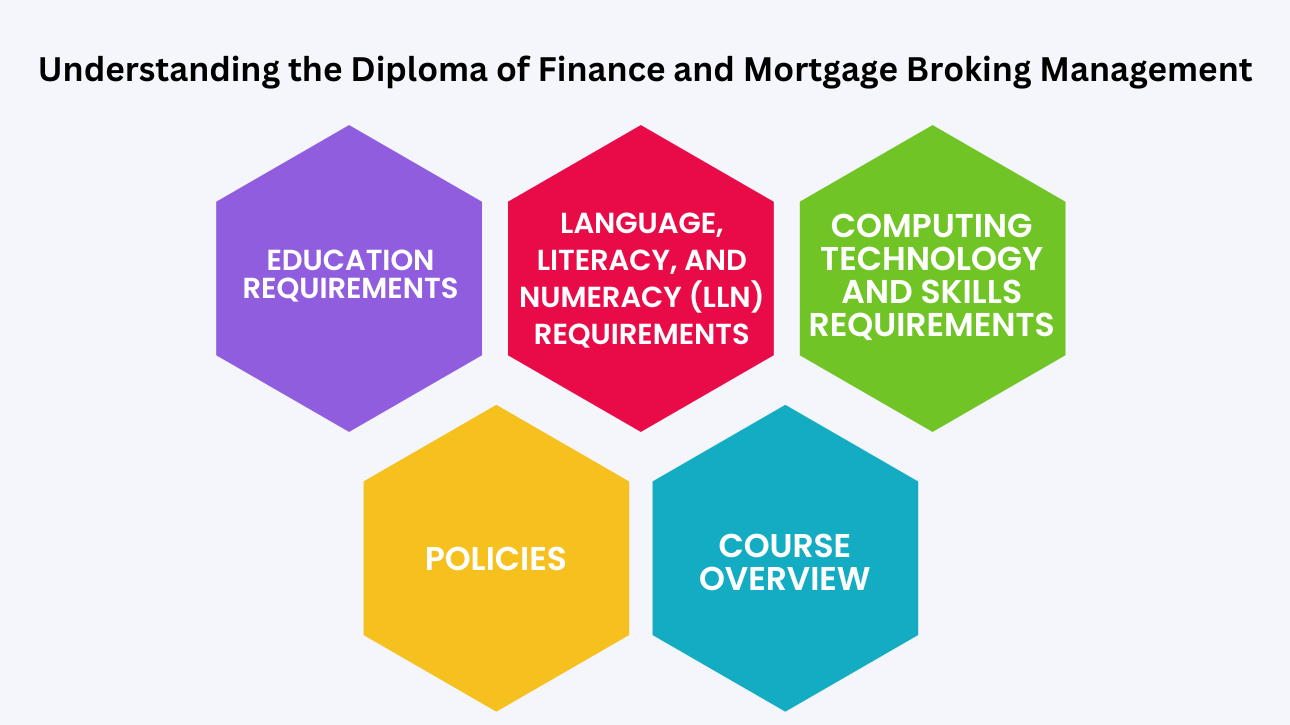

Understanding the Diploma of Finance and Mortgage Broking Management

Education Requirements

- Foundational Knowledge: Basic understanding of math and finance principles.

- High School Completion: Equivalent to Australian Year 12 education or relevant work experience.

Language, Literacy, and Numeracy (LLN) Requirements

- Communication Skills: Ability to read and interpret various documents.

- Numeracy Proficiency: Comfort with numbers and basic calculations.

Computing Technology and Skills Requirements

- Digital Literacy: Familiarity with typical software applications.

- Technical Skills: Ability to navigate industry standard software used in the mortgage broking industry.

Policies

- Code of Conduct: Adherence to ethical practices in finance.

- Assessment Policy: Clear criteria for evaluating student performance.

Course Overview

- Curriculum Structure: A breakdown of core subjects and electives.

- Learning Pathways: Options for recognition of prior learning and diploma of finance and mortgage broking upgrade.

Diploma of Finance and Mortgage Broking Management – FNS50322

Overview

- Course Duration: Typically one to two years of part-time study.

- Qualification Level: Aligned with the Australian Qualifications Framework for diploma level qualification.

Why Finance and Mortgage Broking at RMIT?

- Reputation: RMIT’s standing in the national finance institute

- Quality of Education: Our commitment is to provide information that is current and relevant to finance broking courses.

Supportive Environment

- Student Support: Access to mentors, live online classes, and leave of absence

- Learning Resources: Availability of real estate training and financial services regulation

Details

- Entry Requirements: Criteria for enrolment in the diploma mortgage broking

- Scope of Registration: Accreditation details and date of registration with the Australian National Training Authority.

How You Will Learn

- Interactive Learning: Engagement through case studies and real-world scenarios.

- Assessment Methods: There are various testing methods to gauge competency in finance and mortgage brokers

Learning at RMIT

- Campus Experience: Overview of facilities and student life.

- Online Accessibility: Flexibility is offered through live online classes and digital resources.

Industry Connections

- Networking Opportunities: Connections with the Finance Brokers Association of Australia and other industry bodies.

- Work Placement Programs: Practical experience in the mortgage broking management

Learning Outcomes

- Skill Development: Competencies in identifying client needs and offering commercial lending options.

- Career Readiness: Preparedness for immediate entry into the financial services industry.

Contact Hours and Study Load

- Weekly Commitment: Expected hours of study per week.

- Flexibility: Options for managing study alongside work and personal commitments.

Electives and Course Plan

- Customization: Ability to tailor the course with electives that suit career goals.

- Progression Table: Suggested order of units for optimal learning experience.

Course Structure

- Core Units: Essential subjects required for diploma mortgage broking.

- Elective Options: Additional subjects to broaden knowledge and skills.

Career

- Job Prospects: Potential career paths and roles in the finance and mortgage broking management

- Professional Development: Continuing education opportunities and certifications.

Learning Journey in Mortgage Broking

Details

- Course Length: Typically 1-2 years part-time.

- Accreditation: Recognized under the Australian Qualifications Framework.

How You Will Learn

- Interactive Sessions: Engaging with live online classes and workshops.

- Practical Application: Using industry standard software for real-world tasks.

Learning and Teaching

- Expert Instructors: Learning from professionals in the mortgage broking industry.

- Peer Collaboration: Group work to enhance understanding of finance and mortgage broking management.

Assessment Methods

- Diverse Evaluations: A mix of exams, projects, and practical assessments.

- Competency-Based: Focus on units of competency relevant to finance broking courses.

Learning at RMIT

- Campus Resources: Access to libraries, study spaces, and support services.

- Online Resources: Comprehensive digital materials for diploma mortgage broking

Industry Connections

- Professional Networking: Links with the Finance Brokers Association of Australia and other key organizations.

- Real-World Experience: Opportunities for internships and industry projects.

Learning Outcomes

- Knowledge Gain: Understanding of financial services regulation and commercial lending options.

- Skill Set: Developing skills to identify client needs and offer tailored financial solutions.

Contact Hours and Study Load

- Weekly Schedule: Clear outline of contact hours for classes and self-study.

- Study Balance: Guidance on balancing study with other life commitments.

Electives and Course Plan

- Elective Choices: Selection of electives to complement core mortgage broking management

- Course Map: Visual guide to course structure and elective options.

Course Structure

- Core Curriculum: Essential units of competency for all students.

- Specialization: Options for focusing on areas such as commercial lending options.

Career

- Career Pathways: Exploration of potential roles within the financial services industry.

- Professional Growth: Opportunities for advancement and recognition of prior learning.

Enrolling and Completing the Diploma

Course Duration

- Part-time Flexibility: Completion time of 1-2 years, accommodating work schedules.

- Accelerated Options: Availability of faster completion for dedicated study time.

Why Complete the Program

- Industry Demand: There is a high demand for professionals with diploma mortgage broking

- Career Advancement: Opportunities for leadership roles in the financial services sector.

Enrolment Requirements

- Academic Records: Need for high school diploma or equivalent and any relevant recognition of prior learning.

- Professional Experience: Consideration of work history in related fields.

Units of Competency

- Core Units: Mandatory subjects covering essential finance and mortgage broking management

- Elective Units: Courses that allow specialization in areas like commercial lending options.

Financial Support

- Government Funding: Information on eligibility for subsidies or financial aid.

- Payment Plans: Options for managing course fees overtime.

Enrolment Process

- Application Steps: Step-by-step guide from inquiry to enrollment.

- Support Services: Assistance is available for application and enrolment queries.

Becoming a Mortgage Broker

- Accreditation: Pathway to becoming an accredited mortgage broker through the Finance Brokers Association of Australia.

- Professional Membership: Requirements for joining industry bodies post-graduation.

Upgrading Qualifications

- Diploma Upgrade: Options for those with a Certificate IV in Finance and Mortgage Broking.

- Transcript Review: Process for assessing previous education for recognition of prior learning.

Becoming a Mortgage Broker in Australia

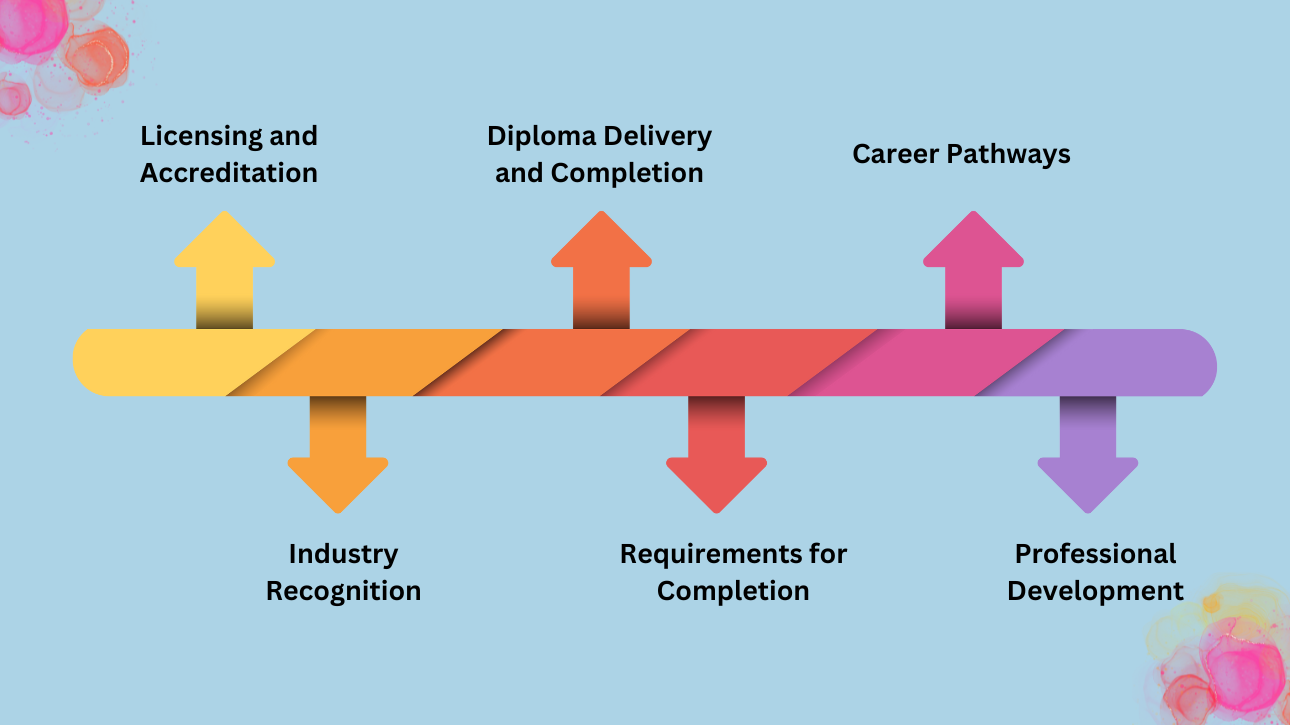

Licensing and Accreditation

- Regulatory Bodies: Requirements set by the Australian Securities and Investments Commission (ASIC).

- Professional Associations: Steps to join the MFAA or FBAA post-graduation.

Industry Recognition

- Diploma Credential: Recognition of the Diploma of Finance and Mortgage Broking Management as a key qualification.

- Continued Education: Importance of ongoing learning to maintain accreditation.

Diploma Delivery and Completion

- Study Modes: Options between online, in-person, or blended diploma mortgage broking

- Completion Timeline: Expected timeframes for achieving the diploma based on study mode.

Requirements for Completion

- Assessment Criteria: Overview of the evaluations and practical assessments.

- Work Experience: Internships or work placements as part of the course requirements.

Career Pathways

- Broker Roles: Various positions are available within the mortgage broking industry.

- Management Opportunities: Advancement to leadership roles through the diploma of finance and mortgage broking management.

Professional Development

- Ongoing Training: Courses and seminars for finance and mortgage brokers.

- Networking: Building relationships through industry events and associations.

Advancing Your Career with the Diploma

Career Advancement Opportunities

- Leadership Roles: Potential for moving into management positions within the financial services industry.

- Specialization: Opportunities to focus on niches like commercial lending options.

The Role of Education

- Higher Learning: How the diploma of finance and mortgage broking management contributes to career growth.

- Lifelong Learning: The importance of continuous education, including recognition of prior learning.

Networking and Industry Connections

- Building Relationships: Leveraging connections made through the Finance Brokers Association of Australia.

- Industry Events: Attending seminars and conferences to stay ahead in the mortgage broking industry.

Utilizing the Diploma

- Professional Recognition: Using the diploma to gain membership in professional bodies.

- Credential Impact: How the diploma enhances credibility and marketability.

Continuing Professional Development

- Ongoing Education: Pursuing further qualifications or specializations.

- Mandatory Training: Keeping up with the financial services regulation through required courses.

Transitioning to the Workplace

- From Classroom to Office: Applying the knowledge and skills learned to real-world scenarios.

- Workplace Integration: Understanding the roles of finance and integrating into a professional setting.

Conclusion and Next Steps

Summarizing the Diploma Benefits

- Industry Preparedness: Equipping students with the skills for the mortgage broking industry.

- Accreditation: Facilitating membership with MFAA and FBAA.

Call to Action

- Enrollment Encouragement: Motivating potential students to take the first step towards a diploma mortgage broking.

- Career Launch: Highlighting the diploma as a launchpad for a career in finance and mortgage broking management.

Endorsing VET Resources

- Resource List: Providing a list of valuable VET resources for further exploration.

- Ongoing Support: Emphasizing the availability of support throughout the student journey.

Next Steps for Prospective Students

- Inquiry Process: Guiding through the process of making inquiries about the diploma.

- Application Guidance: Offering a step-by-step overview of the application process.

Encouragement for Professional Development

- Lifelong Learning: Advocating for the importance of ongoing education in the financial services sector.

- Professional Growth: Encouraging the pursuit of further qualifications for career advancement.

Frequently Asked Questions

Q1. What are ‘special financial circumstances,’ and how does the diploma address them?

- Answer: ‘Special financial circumstances’ refer to unique or complex financial situations that clients may face. The Diploma of Finance & Mortgage Broking Management equips students with the skills to navigate and provide tailored advice for these scenarios, ensuring they can meet diverse client needs effectively.

Q2. How will the diploma enhance my knowledge of financial products?

- Answer: The diploma provides comprehensive training on various financial products. Through coursework and practical assessments, students gain a deep understanding of product features, benefits, and suitable applications for different client profiles.

Q3. What is a unique student identifier, and do I need one for this course?

- Answer: A Unique Student Identifier (USI) is a reference number that creates an online record of your training and qualifications attained in Australia. Yes, you will need a USI to enrol in and complete any accredited course, including the Diploma of Finance and Mortgage Broking Management.

Q4. What happens upon completion of the course?

- Answer: Upon completion of the course, you will receive the Diploma of Finance and Mortgage Broking Management, which qualifies you to apply for membership with professional bodies like the MFAA and FBAA and enhances your prospects in the mortgage broking industry.

Q5. Can I get credit for previous studies or experience through your recognition of the prior learning policy?

- Answer: Yes, our recognition of prior learning policy allows you to receive credit for previous relevant studies or work experience, potentially reducing the time and cost to complete the diploma.

Q6. What is the difference between the Diploma of Finance & Mortgage Broking Management and the Diploma of Finance and Mortgage Broking Management?

- Answer: There is no difference; the terms are used interchangeably to describe the same qualification that provides comprehensive training in finance and mortgage broking management.

Q7. How does the diploma prepare me for managing special financial circumstances for clients?

- Answer: The diploma covers various topics, including risk assessment, loan structuring, and compliance, which are crucial for managing special financial circumstances. You will learn to tailor financial solutions to fit the complex needs of various clients.

Q8. Will the diploma include practical components to apply my financial product knowledge?

- Answer: Yes, the diploma includes practical assessments and, in some cases, work placements where you can apply your knowledge of financial products in real-world scenarios.

Q9. How do I obtain a unique student identifier, and is it required before I start the diploma?

- Answer: You can obtain a Unique Student Identifier online through the USI website. It is a requirement before you start the diploma as it helps keep your training records and results together in an online account.

Q10. What support is available if I am eligible for recognition of prior learning?

- Answer: Our institution offers guidance through the process of recognition of prior learning. Advisors can help you understand the policy, gather the necessary documentation, and submit your application for RPL.

Disclaimer:

The information presented on the VET Resources blog is for general guidance only. While we strive for accuracy, we cannot guarantee the completeness or timeliness of the information. VET Resources is not responsible for any errors or omissions, or for the results obtained from the use of this information. Always consult a professional for advice tailored to your circumstances.